When it comes to financial institutions, there is a lot of challenges and obstacles that need to be tackled in order for them to be in touch with their customers. Strict structure and hierarchy give less space for new technologies and new ways of thinking, while customer data is strictly confidential and communication is usually limited to one-to-one. So, the question is, how to quickly adjust to advances in technology and communication?

💡 Read Media Monitoring: The Ultimate Guide

Social media is becoming completely incorporated in consumers’ lives, hence it is crucial for brands from all industries to understand what it means for them. There is a number of opportunities on the market, and the first step is to recognize them. If they are able to innovate and react more quickly to consumer trends, avoiding the obstacles, there is no end to the advantage companies can gain over competitors.

What is the role of media monitoring in this process?

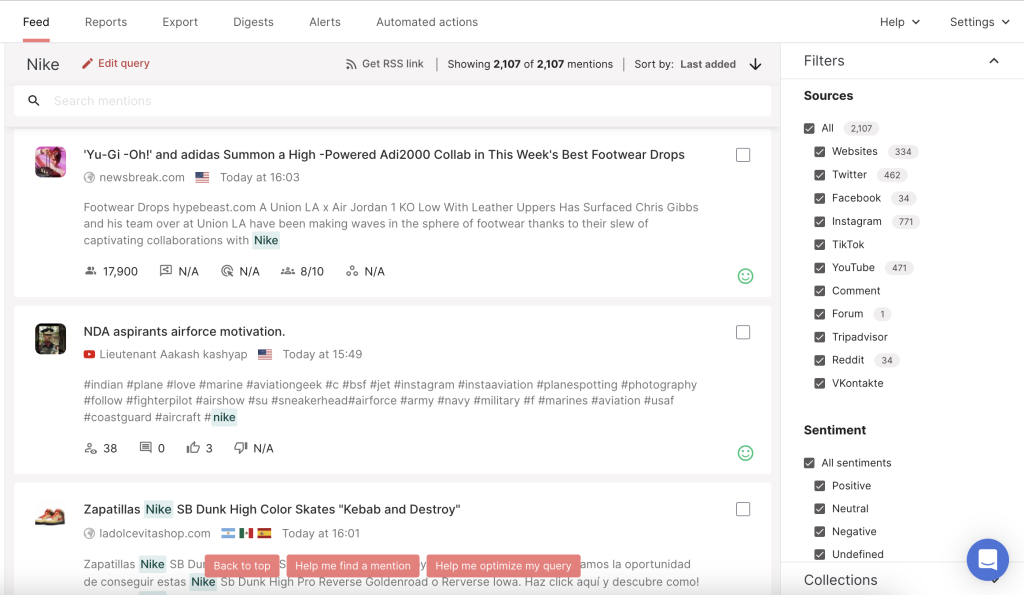

Media monitoring and social listening tools enable you to be in the know with your customers’ opinions, preferences, and needs. By monitoring mentions of your brand, services, relevant topics and keywords, and even your competitors, you can get an insight into very valuable data, such as:

- the sentiment of your mentions (whether the context in which your institutions is mentioned is positive, neutral or negative)

- number of mentions and their reach

- topics that are most often linked to your institution/services

- where your customers are active the most (social media, forums, blogs and so on)

- top users and media outlets that mention your topic

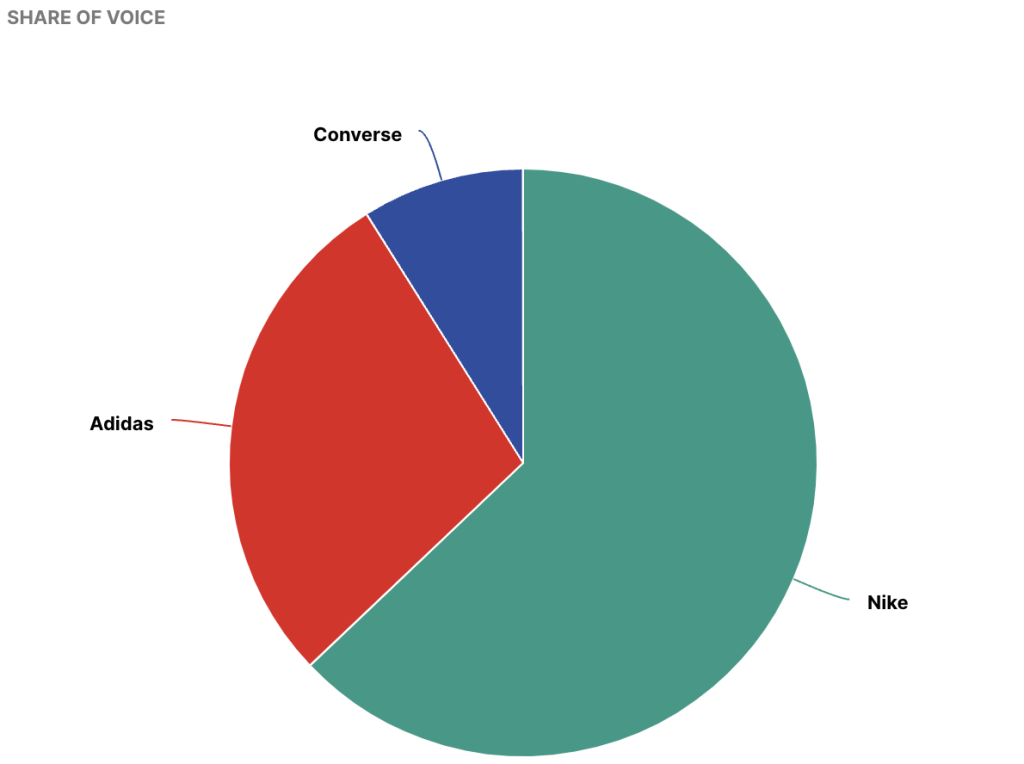

- comparison with your competitors

- insight into competitors’ advantages and disadvantages from an end user’s perspective

…and so much more. Imagine how much you could benefit from knowing all of this information. In fact, there are concrete examples of how you would benefit.

Market research

Did you know that 60% of mentions about loans generated from private users come from forums? So, if you knew where your users were looking for information the most, think of how many opportunities this could mean for your institution. Firstly, you would get an insight into what they are looking for. If their desires don’t match your current offers, you could set up new ones or modify the existing ones to make them more enticing.

Secondly, knowing where most of your potential customers are is a great input for your advertising experts. Target your ads to this exact audience and this exact web location could be a real hit. Or, conclude which network is more important for your future communication strategy so you could improve accordingly.

Read Everything You Need to Know About Marketing of Financial Services

But, let’s take a step back and ask ourselves why are your customers mainly active on forums. Are they looking for information on forums because they couldn’t find them on your website? This is a moment to improve the content of your online outlets, if possible, to better inform your customers. On the other hand, they could be looking for and sharing their experiences, as other customers’ recommendations have great value when deciding on a certain product or a service. If your mentions consist of negative chatter and opinions, it might be time to consider doing the next step.

Customer service

Social media is a platform where customers express their gratitude and their anger, but also give advice and recommendations. Now, if you could identify all the posts where your customers do so mentioning your brand or services, don’t you think it could be a great chance to do customer service?

Traditionally (and when it comes to banks, more formally), customer service has been executed by phone or email. Nowadays, people are using their social media to interact with brands and companies in a more direct, informal way. This is becoming a trend in the banking industry, as well. More and more institutions use their official Pages and profiles to engage with their customers. It is a great way to resolve an issue fast and simple.

For example, Bank of America uses its Twitter account to interact with customers and help with their questions. They refer customers to a private conversation where they can also post more personal details since security and safety are the most important in this industry.

Reputation management

Identifying online mentions of certain problems with your service or bad experiences could represent an opportunity to help those people and build a good image of your brand. But, the negative buzz can affect your reputation, and it can spread like wildfire. When something negative appears online, it’s important to be the first to know about it.

Imagine if your customer had a bad experience with your institution and decided to share it on social media, or aforementioned forums, where users don’t have to be friends or followers to see each other’s posts. Another person tunes in agreeing and sharing his story, and then many more customers do the same. If I was looking for certain services and read a number of negative things, I would pass on your bank and look for what I need somewhere else. Many people would, too.

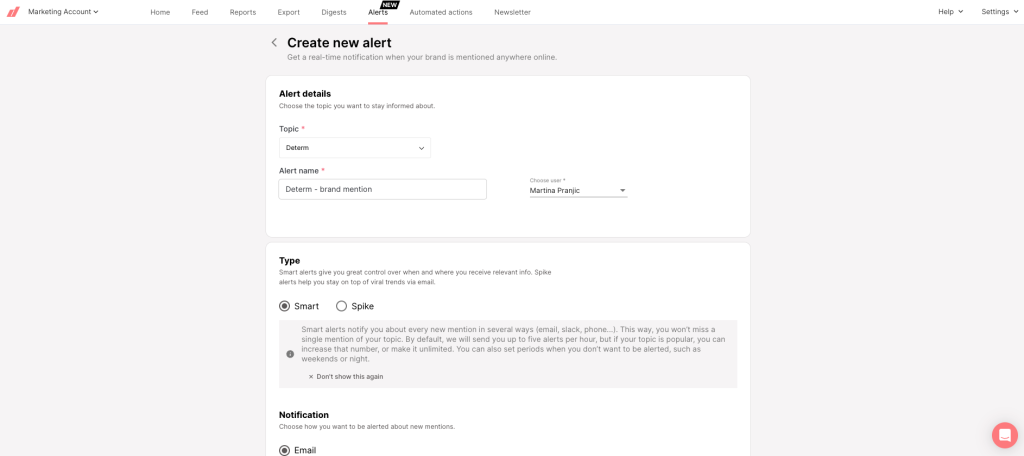

The key is to identify these mentions the moment they happen. Real-time alerts are a must-have in these situations, as they enable you to be quick and proactive.

Marketing targeting

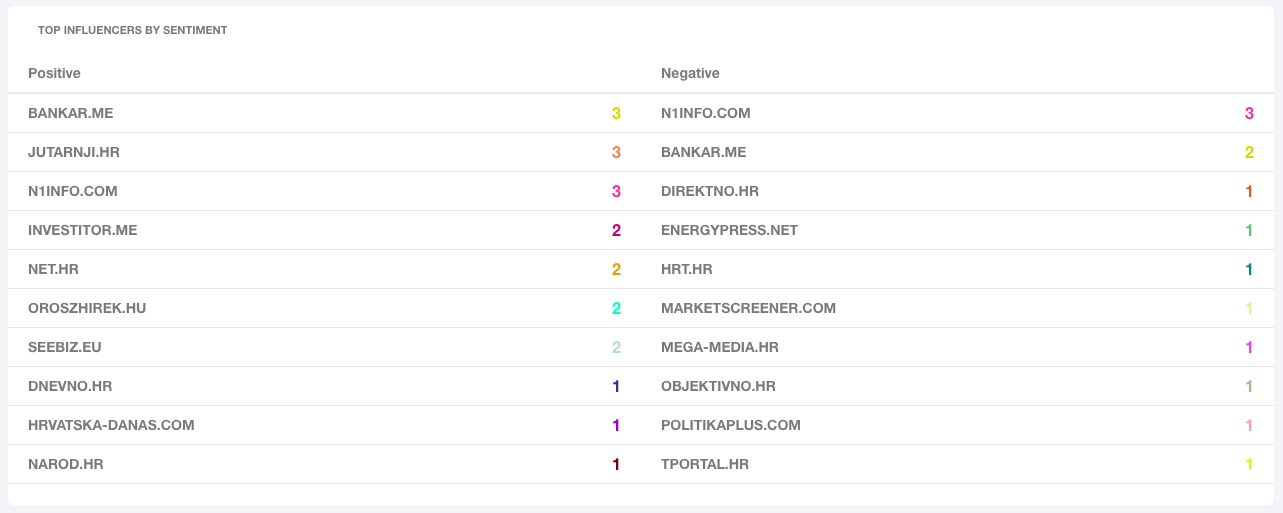

As we’ve mentioned earlier, media monitoring tools can find active communities and conversations taking place online that are highly relevant to your business and your interests. In Determ, they’re located in the Influencer Dashboard. Top 10 influencers, whether they’re users or media, are then sorted by source, sentiment, reach and the number of mentions.

This information means you can identify which users and media outlets are talking about your brand the most. Your Marketing team would be thrilled with this data, as it really simplifies the process of finding the right people to collaborate with and promote your product. Not only people but also social media networks where your (potential) customers post the most or any other online locations such as blogs, forums, comments and so on. Choosing the right channel is much easier if you know where your audience already is. You could also invite the whole team to have access to this data since Determ offers an unlimited user number.

Marketing measurements

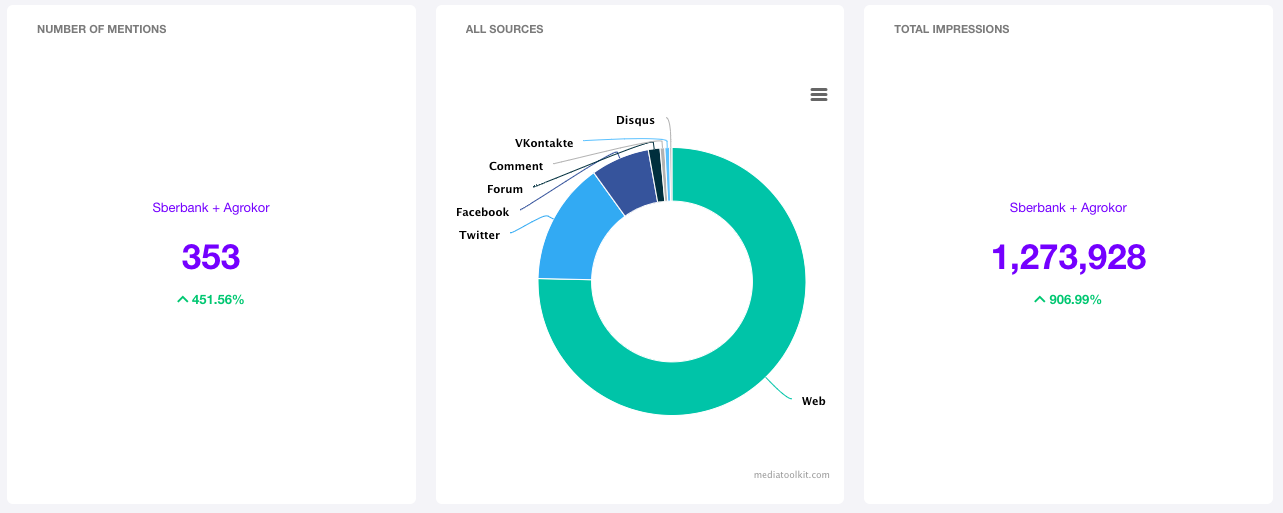

When having an online campaign, a simple metric to add detail to your tracking is the online buzz. You could, for example, measure how many times you’ve been mentioned online, the reach and the sentiment. Then, you could analyze which channels and sources have mentioned you the most. Furthermore, since Determ tracks mentions in any language in the world, you could see exactly in which countries and languages your brand is talked about. Great information, right?

You could also analyze which campaign was more successful if you had two or more active at the same time. By using Competitive analysis, other than for measuring how you stand in comparison to your competitors, you could see which one generated more online conversation and engagement. Hence, you can spot certain trends regarding your target audience and improve your future campaigns and overall strategy.

Where to begin?

So, to sum it up, media monitoring and social listening tools can be a great asset when it comes to better understanding your market and your customers. If you were wondering how to make it happen, we suggest starting with monitoring the following topics:

- name of your company

- your products and services

- key people in the bank (board members, directors, owners…)

- specific topics in connection with the bank (for example “Sberbank” in connection with Agrokor)

- your competitors and their key people

- news from the industry in general

Take it from here and further analyze your data. Media monitoring platforms will give you the needed metrics, that help to filter and sort important from unimportant data. Hence, you can prioritize what your customers are interested in the most.

Interested in tracking your institution?